Personalized AI Agent for Managing Financial Transitions

Speculative UX Design / AI Agent System / Fidelity-funded Team Project

Project TypeYearDimensions:Jan–Apr 2025

Variable

LocationRaleigh,NC

My RoleInterface Design/ Prototyping / Motion Design

Software and techniques usedSoftware: Figma, Adobe After Effects, Adobe Illustrator

Techniques: Multi-agent system mapping, interaction prototyping, motion design, narrative scenario development, interface exploration

Project DescriptionThis project explores how multi-agent AI could support families during emotionally complex periods of wealth and knowledge transfer. In collaboration with Fidelity, our team designed a speculative system set ten years in the future, imagining how AI “doubles” could assist users with responsibilities such as power of attorney, financial coordination, and communication across family members and advisors. The work combines user research, narrative scenario development, and speculative prototyping to envision a more transparent, empathetic, and collaborative financial future.

UX/UI DesignTarget Audience

This system is designed for adults navigating major financial transitions, including individuals stepping into new roles such as POA, families managing generational wealth, and financial advisors guiding clients through emotionally charged decision-making. It supports users who want clarity, confidence, and reduced stress during sensitive financial moments.

Design Problem

Fidelity challenged our team to explore how AI might extend or exceed the capabilities of human advisors, and how future tools could support families during wealth and knowledge transfer. To address this, we examined how different generations learn about finances, how families negotiate responsibility, and how AI can meaningfully enhance, rather than replace, human interactions.

Financial transitions are both logistical and deeply emotional. Through interviews and persona development, we centered our research around Scott, a 53-year-old engineer newly designated as his mother, Lydia’s, POA. Scott struggles to understand her estate, navigate what information to share with his sister, and explain the reasoning behind his role, all while trying to maintain family harmony. These challenges revealed the core design question: How might AI reduce emotional strain, improve communication, and clarify decision-making during moments when families need support the most?

Design Process

1. Interviews & Insights

We interviewed a Fidelity advisor and a participant whose circumstances closely matched our persona. These conversations revealed the emotional tensions beneath financial decision-making, uncertainty, responsibility, fear of conflict, and gaps in confidence.

Interview Questions for a Financial Advisor

Describe to me some of your roles in your current position.

If you take on a new client who has had a financial advisor in the past, does their portfolio start over from scratch? If yes, what aspects would you prioritize when building their portfolio?

When you take on a client who has transitioned from another investment firm, what do you see as the biggest challenges?

Let’s say you have a new client who recently inherited $80K from his mother, who’s still alive. He is middle-aged, has a steady career, a family, and doesn’t have debt. What would you advise him to do with the money?

How do you address the emotional or psychological side of wealth management, especially in situations involving family?

Do you think AI could automate, complete, or assist any labor-intensive tasks within your role? Why or why not?

What do you enjoy most about your role and why?

As a financial advisor, how do you maintain emotional neutrality and make rational decisions while still building trust and strong relationships with your clients? What strategies do you find most effective in striking this balance?

How might you assist a client with gaining financial literacy or terminology understanding within a financial process?

Interview Questions for Scott

Let’s say you inherited $80K and you have no debt, what would be the first thing you do?

Let’s say you become POA for your mom. How do you feel about taking on this responsibility, and what would be your first steps in handling her financial matters? Are there specific aspects of this role that you think will be particularly challenging or overwhelming?

What is the most difficult financial-related experience you’ve had and why?

How do you approach long-term planning - like retirement and your children’s education?

If you currently have two financial advisors but decide to switch to the advisor your parents previously used, what concerns or challenges do you anticipate during this transition? What factors would influence your decision to trust or not trust this new advisor?

What are some ways you struggle with your financial advisor, or what dictates a bad experience?

What are some ways AI could improve financial service processes?

What are some common technologies or methods that you use to manage your finances?

2. User Persona

Scott emerged as a user who values clarity and fairness, yet feels overwhelmed by legal expectations and family dynamics. His persona shaped the emotional and practical goals of the system.

Family Tree

3. Journey Mapping

Mapping Scott’s experience highlighted consistent breakdowns in clarity, communication, and preparation for advisor meetings. These insights guided our design requirements.

4. Benchmarking Future Technologies

We explored future-facing systems, including assistive AI, biotech identity tools, and speculative physical devices, to envision how financial management might evolve over the next decade.

5. Ideation

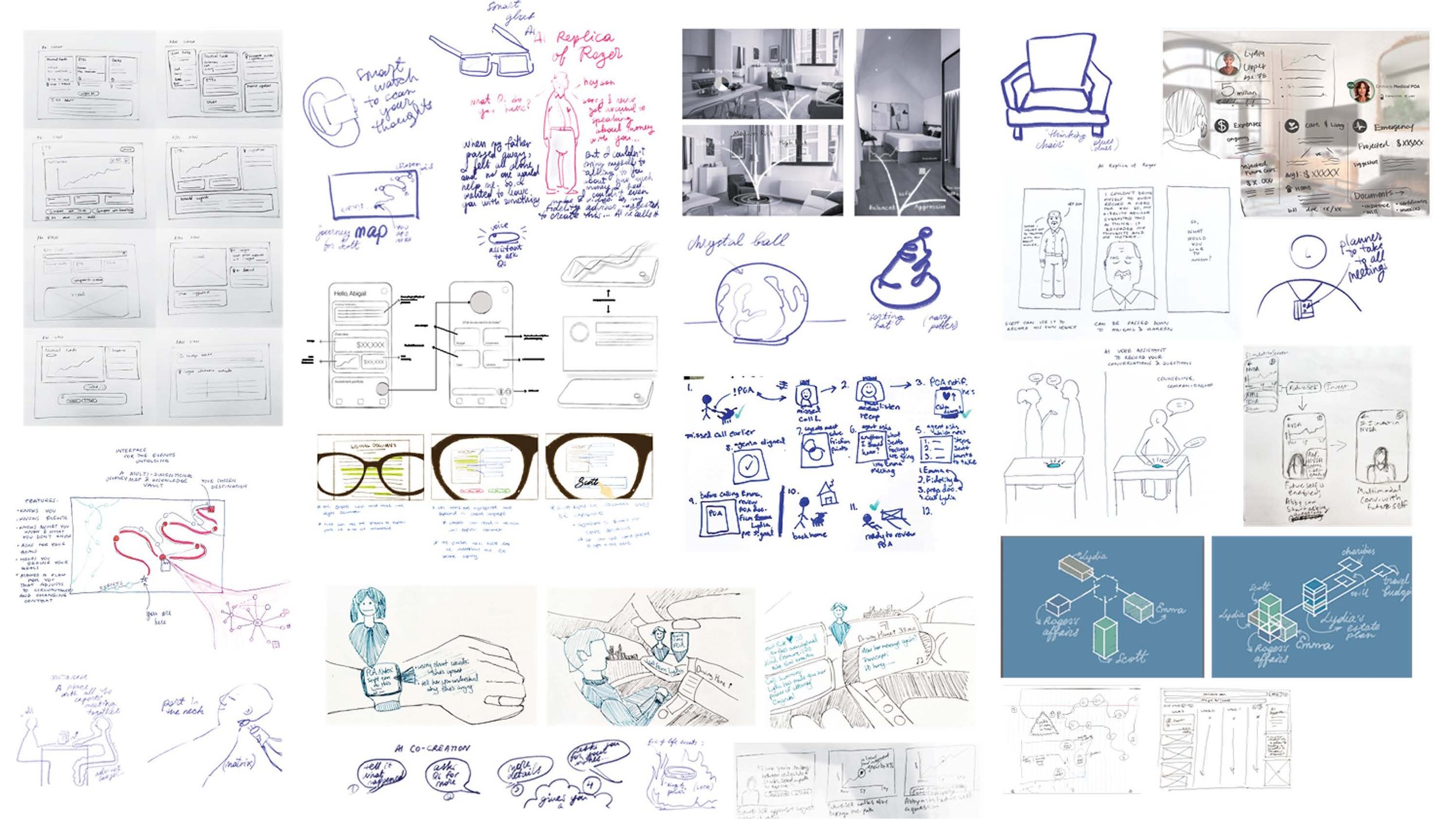

Through What-If probes, narrative exploration, and non-traditional dashboard sketches, we generated concepts that foreground transparency, emotional intelligence, conflict mediation, and inter-agent collaboration.

6. Concept Development & Crit Rounds

During early concept development, our team generated a wide range of speculative directions for how AI might mediate financial transitions. The full set of explorations spanned dashboards, conversational agents, multiview interfaces, and cross-agent negotiation models.

In this section, I highlight only the concepts I personally developed during Crit Round.

Concept One — Reducing Meeting Overload Through Delegation

This concept examines why Scott is repeatedly overwhelmed during financial advisor meetings and reframes the process through strategic AI delegation.

By mapping where cognitive overload occurs, such as information density, difficulty comparing proposals, and constant follow-up inquiries, the concept identifies an opportunity for a personal AI agent to step in. Instead of requiring multiple human meetings, Scott attends only one high-level session, while his AI Twinvestor handles follow-up tasks, gathers missing details, compares institutional offerings, and prepares synthesized recommendations. The goal is to preserve Scott’s agency while reducing emotional strain, enabling him to make clear decisions with the support of an intelligent and transparent assistant.

Feedback

Feedback emphasized that although the concept addressed meeting overload, it still resembled a contemporary dashboard-based workflow. Reviewers reminded us that this project imagines a system used 10 years in the future, where AI agents will be far more autonomous and interface patterns will likely move beyond checklists, progress bars, and conventional desktop layouts. The critique prompted us to reconsider the nature of interaction itself, shifting from static screens to more intelligent, anticipatory, and adaptive agent behaviors.

This led us into Concept Two, where we began to explore how future agents might act more independently while still maintaining transparency and trustworthiness.

Concept Two — Centralizing Tasks & Reducing Meetings Through AI Coordination

This concept explores how an AI-driven task ecosystem can reduce the number of meetings Scott must attend while maintaining full transparency around financial decisions.

Instead of navigating fragmented information across institutions, Scott interacts with a centralized task environment where he can delegate work to his AI agent. The AI manages routine tasks, such as comparing financial proposals, gathering necessary documents, and coordinating with advisors. Meanwhile, a digital-twin representation of his mother enables the system to simulate conversations and resolve issues before human discussions occur. Scott remains in control by monitoring real-time progress and reviewing AI-generated summaries, ensuring clarity without the burden of repeated meetings. By blending automated coordination with transparent decision support, this concept reduces emotional strain, minimizes redundant communication, and allows Scott to focus on strategic, high-value choices rather than procedural logistics.

Feedback

Critiques for Concept Two focused on deeper questions of transparency, control, and privacy. Reviewers asked how the agent negotiates what to surface, how users influence decisions, and how the environment or device affordances shape interaction—especially in quick vs. detailed engagements. They also encouraged us to consider biometrics, adaptive trust, layered complexity, and real-world patterns of information overload. Another key question was timing: should Fidelity’s agent appear earlier in the process to provide clarity sooner?

This feedback revealed important gaps in the emotional and relational dimensions of the system: Scott may not yet fully trust the agent, may want to verify logs, or may require more nuanced privacy controls when coordinating with family members. These insights led us to Concept Three, where we expanded the agent ecosystem and explored multi-agent coordination across different personal and family contexts.

Concept Three: Multi-Agent Collaboration for Emotionally Aware Family Coordination

This concept explores how Scott can manage his family’s financial transition while maintaining an emotional connection to both Lydia and Emma.

By placing the scenario inside an autonomous vehicle, we show how Scott receives urgent POA notifications in a calm, contextualized environment, supported immediately by his AI agent. As the narrative unfolds, multiple AI agents come into play: Lydia’s AI helps interpret legal and financial details, Emma’s AI surfaces her emotional concerns and communication preferences, and Scott’s AI synthesizes these inputs into clear next steps. Instead of Scott juggling fragmented conversations, each agent communicates on behalf of its user, aligns information in the background, and prepares concise updates for Scott to review. This system reduces emotional strain, prevents miscommunication, and ensures transparency across the family, allowing Scott to focus solely on decisions that truly require his involvement.

Feedback

Reviewers were interested in the multi-agent ecosystem and its potential to support family communication; however, they raised concerns about the context of use, particularly in the autonomous car scenario. Many felt that discussing sensitive financial information inside a vehicle felt too speculative or uncomfortable for users, even in a 10-year future vision. They encouraged us to refine the environmental contexts and consider where users would realistically want to engage with emotionally charged tasks.

However, they strongly supported the direction of giving each family member an agent, allowing those agents to negotiate on behalf of humans, and exploring how emotional states, permissions, and information boundaries differ within a family. This feedback guided the refinement of our final system: emphasizing the multi-agent architecture while grounding interactions in more appropriate and flexible environments.

6. Final Design — Multi-Agent AI Ecosystem

Scenario

When Lydia tells Scott she has chosen him as her POA, he feels uncertain about next steps. His Fidelity AI agent begins coordinating with Lydia’s and Emma’s agents—surfacing documents, clarifying responsibilities, resolving conflicting assumptions, and preparing Scott for advisor meetings. The system supports both the emotional and informational weight of the transition.

Key Interface